Most working and retired Australians are earning significantly lower returns on their investments than high net worth investors. This makes a considerable difference to their respective wealth creation, especially over time, and widens the chasm between the wealthy lot and the rest of the population. This inequality needs to be removed, not only to reduce the social imbalance but also to significantly improve the Australian economy.

I have set out below a supporting argument, which is followed by some comments on what I regard as the cause of this inequality.

________________________________

Let’s take a look at where the two groups invest and the returns on investment they expect to earn.

- The general population:

Where do they invest? Most working and retired Australians invest in managed funds. The compulsory superannuation contributions made by employees together with any salary sacrifice contributions are generally invested in industry, corporate or other class of managed funds. Those who have accumulated savings also tend to invest those savings in managed funds. Even those with self-managed super funds invest in managed funds. As a result the managed funds industry is managing some AUD 2.1 trillion (per APRA’s Annual Superannuation Bulletin – June 2016). A significant amount of money!

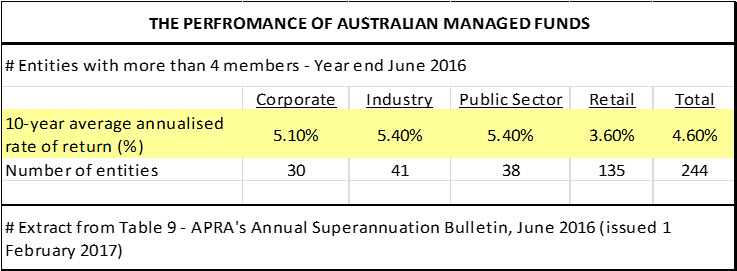

What do they expect to earn? The Australian Prudential Regulatory Authority (APRA) publishes the performance of the managed funds industry and of various categories of managed funds (industry, retail, corporate, etc) in its Annual Superannuation Bulletin. Its latest report (at the time of writing) is for the period to June 2016 and can be found by following this link: (http://www.apra.gov.au/Super/Publications/Pages/annual-superannuation-publication.aspx). This report, amongst others, sets out returns the managed fund industry as a whole and each category of fund have generated over the past 10 years. The results for this period (for the 10-years to June 2016) were as set out in the table below:

These range from a low of 3.6% averaged annualized return per annum in the case of Retail Funds to a high of 5.4% pa in the case of Industry and Public Sector Funds. The average 10-year return for the managed industry as a whole was reported to be 4.6% pa.

I have also stated in a separate piece that market research has shown that investment in residential real estate has over the past 10 years or so, a period that has seen significant capital growth, generally generated returns of only marginally above 4% pa.

In summary, most Australians invest the bulk of their savings (excluding investment in residential properties) in managed funds and residential real estate. Based on historical performance they can generally expect to earn returns of 4% to 6% per annum over the medium to long term from managed funds and … % pa from residential. It would take a bold person to argue that they can expect a much higher return over the next 10 years.

- High net worth investors

Where do they invest? High net worth investors prefer to invest the bulk of their wealth in unlisted companies. In doing so, they want to rank ahead of the founder/s or current owners of the business. In some cases they invest through preference shares while in others through subordinated loans together with a warrant that gives them a right to share in the profits of the business.

What return on investment do they expect to earn? While they say they seek a return on their investment of about 25% pa, they generally target a much higher return. Their 25% pa return assumes their entry multiple is the same as their exit multiple. The reality is that they expect a much higher exit multiple than their entry multiple. For example, they may want to buy in at a 4 times EBIT (earnings before interest & tax), grow profits and sell on an 8 times EBIT multiple.

You may well wonder whether it is realistic to aim for a 25% return. In other words, why would a private company agree to pay such a high return for the additional capital? The answer is that there are many situations where a company can justify paying such a return. This applies to the acquisition of SME businesses and to projects with a relatively short payback period but a longer useful life.

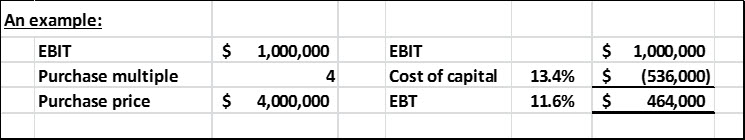

Small to medium sized enterprises (“SMEs”) generally sell on a 3 to 4 times EBIT multiple, which equates to a return on investment of 33.3% and 25% pa respectively. There is at least a reasonable expectation that a business buying another can fund part of the purchase with a loan (or debtor, equipment or real estate finance) from a bank. If the purchaser can fund 60% of the price with a loan at 5.6% pa (30-day BBSW of circa 1.6% + a 5% margin) and the balance at 25% pa, its cost of capital would be 13.4% pa. That results in a 11.6% pa (25% – 13.4%) net EBT (earnings before tax but after interest costs) benefit for the purchaser. It would probably also expect some cost savings to result from the purchase, which would further increase its EBIT and so also its net benefit.

Although a company would be able to increase shareholder value despite paying 25% pa for the additional (non-bank) capital, you may well be wondering why it needs to pay such a high rate for it. The answer is basically because the market for capital in Australia is not efficient and particularly inefficient as regards unlisted companies. Unlisted companies generally have great difficulty securing additional (non-bank) capital and need to pay considerably more for it than do top-listed companies.

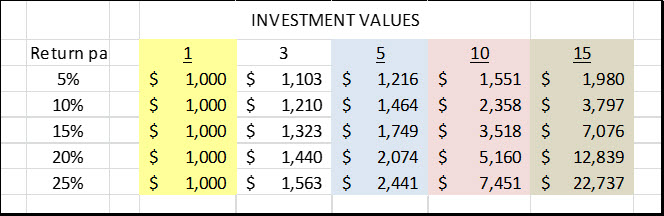

I have argued above that whereas most investors in Australia expect to earn a return of about 5% per annum on their investments, high net worth investors expect to earn 25% per annum. With a view to giving some perspective to these rates of return, I have included a table below that shows the growth in an investment of $1,000 over various periods of time (up to 15 years) at different rates of return.

You may be wondering how this situation has come about. I see it as being the result of three things, which (in no particular order of priority) are the following:

- One is legislation designed to protect ‘Mom and Pops’ has resulted in them being deprived of the opportunity to invest in unlisted securities. This legislation places restrictions on the ability of unlisted companies to promote their capital raising and adds significantly to the cost of preparing the prospectus / offer document, which has resulted in many businesses regarding the cost to be prohibitive.

- Another is that successive governments, our corporate cop (ASIC) and corporate watchdog (ACCC) have allowed the financial planning industry to misrepresent themselves to the market as providers of financial advice, whereas in reality they are essentially merely an outsourced sales function for the funds management industry. If they genuinely provided financial advice they would be open to, in fact they would encourage, businesses to bring them investment opportunities with high expected returns-for-risk. So even if businesses go to the time, effort and cost of producing a product disclosure statement, how do they get access to prospective investors? There is no market or profession to approach that would give one access to prospective investors.

- A third is that the funds management industry is complacent. It is much easier following the herd! They are not at risk of losing their gig by doing what everyone else is doing. Managed Funds generally invest in the top end of the ASX and other major stock exchanges around the world. They generally don’t invest in unlisted businesses. Some invest a small portion in venture capital and private equity funds, but these (at least in the Australian market) don’t suit or are not available to most Australian businesses.

Our political lot should remove the disparity between the returns expected to be earned by the wealthy lot and the returns the rest of Australia expect to earn. I would suggest the following changes should be considered, again in no particular order of priority:

- The legislation relating to the preparation of ‘product disclosure statements’ and the restrictions on the promotion of investment opportunities should be scrapped and replaced by guidelines for their interpretation. These days’ product disclosure statements (prospectuses for the retail market) are prepared by compliance lawyers and lack the information needed by the investment community. There have been numerous corporate and trust collapses despite having issued product disclosure statements.

- The financial planning industry (and others) should be prohibited from promoting themselves as providing financial or investment advice if they receive sales commissions or similar on any product or service recommended to a client and should be required to disclose in ‘big & bold’ statements that they are acting for ‘the other side’.

- The Future Fund should be encouraged to allocate capital to investing in (debt, equity and hybrid securities issued by) unlisted companies and establish a team to assess and evaluate such opportunities.

- The various Unions should encourage their associated Industry Funds to invest in unlisted companies in their sector. This would increase employment in their sector, increase union memberships, increase business profitability and therefore also increase salary and wage growth in their industry.

Making these changes would provide an enormous boost to the Australian economy because it would give the vast majority of businesses in Australia access to the capital needed in order to achieve their growth potential. This in turn would lead to their generating higher profits, employing more people, paying higher salaries and wages and paying more taxes. And the higher levels of employment and personal income would lead to more spending and more personal taxes being paid.

By: Mark M.J. Morris